VA Loans: Did You Know?

Ever wonder what the ins and outs are for a VA Loan? Look no further, About Redlands Realty & Loan is here to give you an overview!

Our veterans deserve the world from us. About Redlands Realty & Loan is beyond honored to put this brief explanation of the VA home loan together in hopes that the information is helpful to our veterans, even in a small way.

Who is eligible for a VA loan?

Military service personnel having spent a minimum of 181 days in service or completed their enlistment and received any release other than dishonorable, are eligible for a VA home loan. If a veteran and their spouse want to purchase, they can use one entitlement, or – if they’re both veterans – they can choose to use both/dual entitlements. Two veterans but not married using Split Entitlement can purchase together. A veteran and a non-veteran but not married would not be eligible for a VA home loan together. Or surviving spouse, child, or parent of a service member who died in the line of duty, or the survivor of a Veteran who died from a service-related injury or illness.

How do I get a VA loan?

Your loan originator can fill you in on all the little details. All lenders and brokers must be approved by the Veterans Administration in order to originate a VA guaranteed home loan. We have this designation and welcome any questions (Contact Us).

How long does a VA loan take?

VA purchase and refinance (rate and term, or cash out) loans take the same amount of time as a conventional loan. An interest rate reduction refinanced loan (IRRRL) is quick, but a VA Rehabilitation Loan will take extra time. In all cases, being able to use a VA loan is one of your benefits for serving our country proudly with honor… and you deserve it, earned it - and we thank you for your service!

So how many VA loans could a veteran have?

VA loans are mostly for a veteran’s primary residence or to do an IRRRL from a primary to an investment. This means a veteran would usually only have 1 or 2. But the number of VA loans will be totally dependent upon the amount of entitlement used.

Can you use a VA loan to buy a “second home”?

In real estate, second homes are properties where owners only live in a short amount of time – for example, whether for holiday celebrations or family getaways. Unfortunately, a VA home loan is 100% Loan to Value (LTV) purchase money of a primary residence and can have the funding fee added in to go over 100%. It can be applied to the purchase of the following property types:

- Single-family residence

- Condo

- Townhome

- Modular

- Manufactured

Note: The difference between a modular and a manufactured home is that a modular is built in a factory. It is then craned onto a truck, delivered to the installation site, and permanently affixed to the foundation. On the other hand, a manufactured home is built on a chassis/frame of a trailer. It is then towed to the installation site, unhooked, wheels/axles removed from underneath, and the manufacturer’s specifications of how to affix the home to the land is followed allowing the home to become real property, rather than personal property.

What is the VA funding fee?

The US Department of Veterans Affairs defines the VA funding fee as a “one-time payment that the Veteran, service member, or survivor pays on a VA-backed or VA direct home loan.” It also mentions that this fee helps U.S. taxpayers by lowering the cost of the loan, especially since the VA home loan programs don’t require down payments or monthly mortgage insurance. (Source)

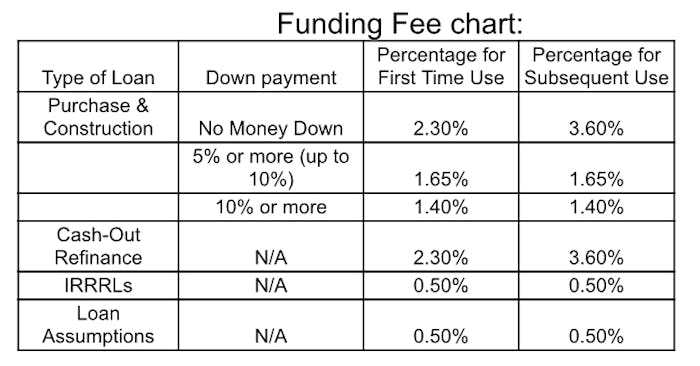

The amount of funding fee varies depending on the usage – first-time use or subsequent use. This amount also depends on whether you're doing an IRRRL or you have a service-related disability and are being paid. The Blue Water Navy Vietnam Veterans Act, also known as House Resolution 299 (HR 299), addresses a variety of Vietnam-era, Korean War-era, and Gulf War-era issues associated with VA medical claims and exempts/reduces the funding fee for those personnel.

Questions? Contact David,About Redlands Realty & Loan

The Veterans Administration does not purchase or originate home loans, rather they guarantee 25% of the total loan (dependent on the veteran’s certificate of eligibility and their remaining entitlement). A veteran can obtain a certificate of eligibility online which would allow lenders to determine the loan amount guarantee and eligibility. Max loan limits are usually based on the county loan limit in your area. In San Bernardino/Riverside Counties, the loan limit is $510,400, but San Diego County’s loan limits are $701,500 while Los Angeles/Orange Counties’ limit goes up to $765,600. These limits are for a single unit property and increase if you choose to purchase a 2-4 unit property.

Loan amounts above the previously listed values are allowed and, technically there is no maximum loan limit. If the overall value of the property of a VA loan user is above the county limit, 25% of the difference (amount over the county loan-level limit) would need to be paid at closing. For example:

- $600,000 – Value of property in San Bernardino County

- ($510,400) – San Bernardino County VA loan limit

- $89,600 – Difference between property value and loan limit

- To purchase this property, VA loan users will need a $22,400 down payment - calculated by taking 25% of the $89,600 difference.

In comparison, if you were doing a conventional loan with 5% down (Financing Options), you would put $30,000 as a down payment rather than the $22,400 on a VA loan. Credit scores requirements can vary, but with most investors, you will need a 640 to start and a 700 to get approval for a VA loan over $1 million.

Debt to Income (DTI) ratios are rarely an issue when doing a VA loan. The administration is more interested in residual income. This residual income amount is calculated to protect the veteran and enable enough disposable income to pay utilities etc. Reserves are not generally required unless vacating a primary residence and turning the property into an investment, in which case there are several allowances for this in the guidelines.

This can be a lot of information, so, please contact us with any and all questions! We can't wait to chat with you.